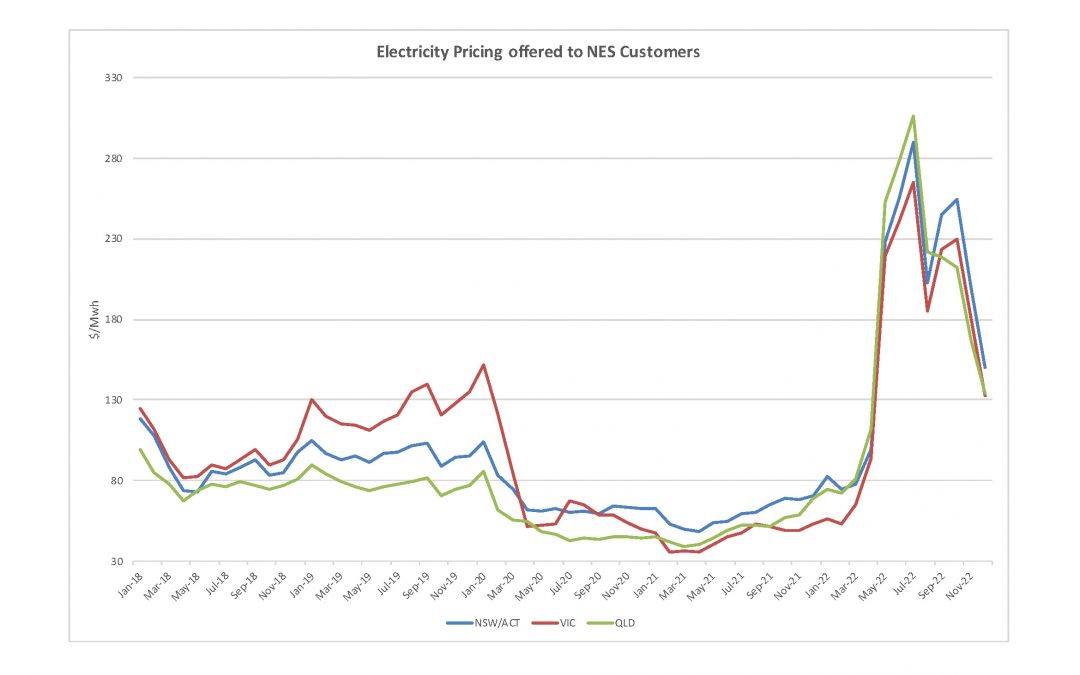

Whilst pricing during 2020 and 2021 had decreased significantly, 2022 has seen pricing reach unprecedented highs. A combination of events has caused this, with some softening in the later part of the year and more material reductions forecast for 2023 and beyond.

The main causes of these pricing shocks are:

- Generation Asset Failures – A number of generation assets have failed, roughly 30% of the NEM capacity has been offline due to these failures, this alone would normally lead to a significant increase in costs. Some of these assets are soon to be recommissioned, with others coming back online over the next few months.

- Global Gas and Coal Prices – Global gas and coal demand has increased significantly due to sanctions affecting gas and coal imports into Europe, these international pricing surges flow through to domestic pricing, which is a direct pass through pricing impact to electricity generation. Domestic Spot pricing for Gas has quadrupled and demand for gas generation increased by 34%. Domestic Spot pricing for electricity has hit near $1,000 MWh, roughly 80 times the norm.

- Extended adverse weather conditions – Extended wet weather during the first half of 2022 has materially reduced generation from Wind and Solar generation assets, both of which have been the prevalent source of new generation assets in recent years. Solar generation was down 37% in May. Higher levels of moisture in coal has impacted the efficiency of coal fired generators, requiring more coal to be used, and flood impacts have affected the supply of coal.

- Extreme cold conditions –Cold weather conditions through Q2 caused an increase in demand for heating, and surged this demand earlier than normal for the winter peak.

Whilst some of these impacts can be resolved over coming months, which is forecast to see pricing improve, the impact of international pricing is likely to be a longer term impact. Recent announcements by the Federal Government to implement price caps, review generation capacity payments and increase gas reserves will further stabilize the market.

It was interesting to observe that the market impacts saw the traditional trends of a decrease in pricing during Spring to be a significant increase in costs which then eased coming into Summer.

Bundled Electricity Tariffs are reviewed each year, normally aligning with a review of the regulated tariffs which is the maximum rate that can be charged. The most recent increases from July were small and did not capture the increases in the market, largely insulating SME and Residential Consumers from the increases in the hope the market volatility would be short-lived. This was unrealistic and tariffs will inevitably increase materially from 1 July 2023 with forecasts of increases up to 30%.

For customers with large SME portfolios, we have seen a benefit in implementing Smart Meters via a Direct Metering Agreement. This enables consumers to understand their load profile with interval data and consider moves to Time Of Use tariffs where it is more favorable, particularly in business environments which often avoid much of the evening Peak.

Internationally, implementation of price caps on Gas from Russia has had a positive impact, and coupled with a warm European Winter, gas futures have plummeted which will have a direct impact on our Domestic pricing.

There is some concern regards ongoing delays in the Snowy 2 project, which is the next major generation augmentation project, and a number of coal generators scheduled for retirement in coming years, but there does seem to be a “scramble” to implement large scale renewable and battery storage projects in advance of any material shortages.

#energysavings #renewableenergy #negawattenergy #demandresponse #energyefficiency